Economics_RS Class 07

A BRIEF OVERVIEW OF THE PREVIOUS CLASS (05:00 PM)

MONETARY POLICY (05:06 PM)

- There should be better coordination between fiscal policy and monetary policy.

- Earlier RBI governor used to decide the monetary policy based on the advice of the Technical advisory committee. Its advice was advisory in nature and the final decision was taken by Governor.

- After the Urjit Patel committee recommendations, a Monetary policy framework agreement was signed between the government and RBI. This led to the constitution of the Monetary policy committee.

- MPC has 6 members (3 from the government side and 3 from RBI), and the decision is taken based on voting. RBI governor has the casting vote and more powers. But it has reduced the RBI's autonomy to some extent.

- It is recommended that Inflation should be the main factor i.e Inflation targeting approach. This target is fixed by Government in consultation with RBI. It can be revised after 5 years. The inflation should be in the range of 2%- 6% of CPI combined.

- After 2011, due to the federal bank's policy and several internal economic problems, the Indian rupee started depreciating leading to a higher inflation level.

- [ * Federal bank's policy and effect on Rupee-

- Federal bank is coming up with a contractionary policy which leads to less dollar supply and interest rate in the US will increase.

- The demand for dollars will increase. It means one is paying more rupees to buy dollars. This means the rupee is depreciating. Depreciation will make the export cheaper.

- Essential imports will become costly- oil, food, fertilizer. It will create a situation of inflation in India.

- When there is a federal tightening/ contractionary policy, it creates an inflationary situation. It was a triggering factor for the fall in Ruppe value.

- There were already some problems such as High CAD, and the economy was not performing well so there was a dilemma between Growth and inflation. ]

- During Lockdown

- Government came up with an expansionary fiscal policy and RBI came up with an expansionary monetary policy.

- When people will not be spending then there was low pent-up demand. After the relaxation of the lockdown, the demand increased. Sudden demand increase led to demand-pull inflation.

- Chinese Zero covid policy disrupted the supply chain and the Russia-Ukraine war also led to cost-push inflation.

- Under these circumstances, inflation went up to 7.9 %. In the developed world also Inflation increased and touched double digits also. All countries adopted contractionary policies.

- Along with high inflation, the GDP growth rate went below 5% consecutively for 2 years. This gap between inflation and GDP has created a dilemma with respect to the focus of monetary policy.

- Urjit Patel's committee was appointed and the committee has recommended inflation as the anchoring factor for deciding monetary policy. Urjit Patel's committee led the foundation of the Monetary policy framework agreement and monetary policy committee.

- Question:- What is inflation targeting? Do you think Inflation targeting is an appropriate mechanism for deciding monetary policy? Discuss (10 marks/ 150 words).

TOOLS USED BY RBI (05:37 PM)

- RBI uses Quantitative and Qualitative tools to control the amount of credit or money supply in the economy. Quantitative tools focus on the overall credit of the money supply whereas Qualitative tools focus on selective credit control i.e. selectively encouraging or discouraging credit for specific sectors.

- Different quantitative tools used by RBI are

- Quantitative tools

- 1) Liquidity adjustment facility (LAF)- REPO rate, Reverse REPO rate.

- 2) Open market operations- Operation Twist.

- 3) Reserve requirements- Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR).

- 4) Marginal standing facility (MSF)

- 5) Bank rate etc

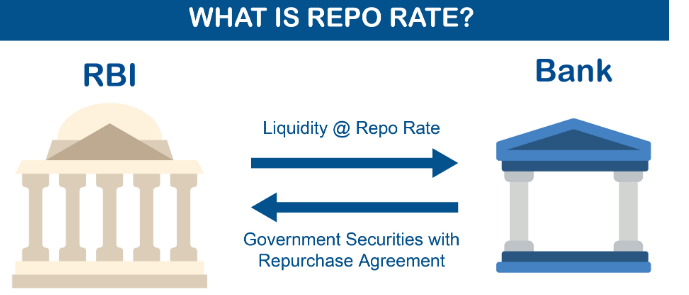

- REPO rate- Repurchase agreement (05:48 PM)

- Earlier these rates were decided by RBI based on the recommendations of the technical advisory committee now it is decided by MPC. Its primary objective will be to check the inflation within tolerable limits.

- It is an interest rate at which RBI lends money to banks and other financial institutions. In REPO there is a repurchase agreement that the G-secs would be re-purchased by the banks after the loan period (REPO= Repurchase agreement).

-

- The banks have to pledge the G-secs. Government bonds are more liquid. These are backed by the security of the government and the government does not default.

- RBI on behalf of the government (Both central + state governments) issues the G-sec. These are for Short-term usually for one day. After the loan period, the banks will get back these securities. At present REPO rate is 6.5%.

- [* If RR increases money supply decreases- It means RBI is giving money to Banks at higher interest and now banks will also give loans at higher rates]

- If the rupee value is depreciating, RBI decided to handle this through the REPO rate. How?- Target- To appreciate the Ruppe. It means Ruppe supply should decrease and hence REPO rate needs to be increased

- Generally, the REPO rate is used as the policy rate except during COVID, the policy rate was shifted to the Reverse REPO rate.

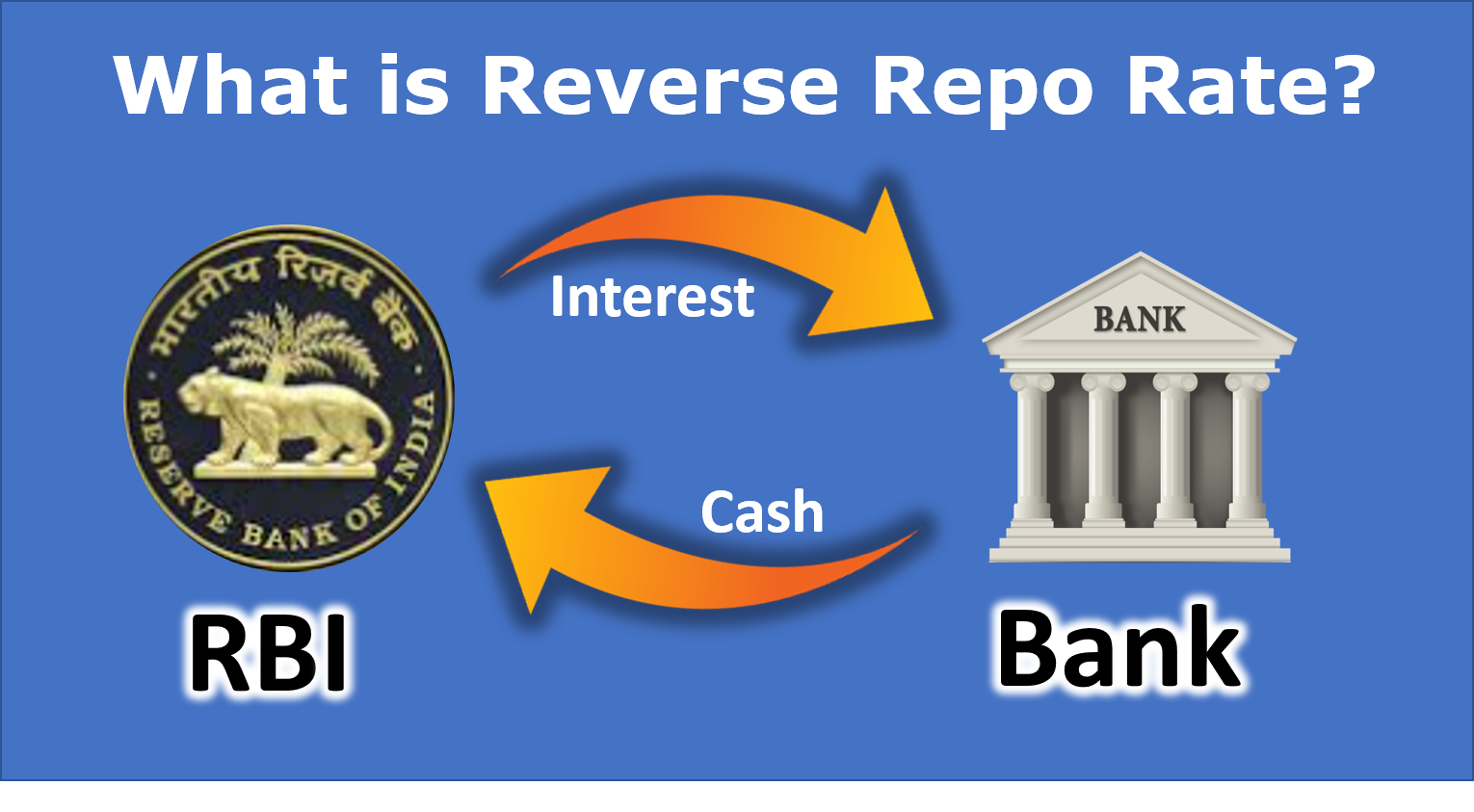

- Reverse REPO rate (06:05 PM)

- It is the interest rate at which Banks and financial institutions park their money with RBI.

- Earlier the difference between the REPO rate and the Reverse REPO rate was 25 basis points (0.25) but currently the gap between REPO and Reverse REPO has been widened to handle the impact of COVID.

- [* Reverse REPO is a tool to take away money from the market. During COVID, the growth was negative and our main focus was on the growth and decreasing the REPO rate and making the loans cheaper. But during COVID banks were not interested in giving loans and they were interested in parking money with RBI rather than giving loans to the Public. ]

- [** Banks were interested in parking the money with the safest option. So this intended objective was not realized. So RBI decided to widen the gap between the REPO and Reverse REPO. RBI decreased the Reverse REPO to 3.35% and REPO was 6.5%. This was done to demotivate the banks to park their money with the RBI. ]

-

- When the Reverse REPO rate increases, the Money supply is going to decrease.

RESERVE REQUIREMENTS (06:36 PM)

- The primary function of the Bank is to do intermediation i.e. by taking deposits and giving loans. Deposits are liabilities for a bank

-

Liabilities Demand deposits/ liabilities

- Example- Savings account

Term Deposits/ Time liabilities

- Fixed deposits

- Which one is more liquid?- Demand deposits are more liquid.

- Banks have total deposits, Total deposits= Public deposits + Other bank deposits.

- Public deposits= Total deposits- Other banks deposits= NET DEPOSITS or Net demand and time liabilities, NDTL.

- Demand deposits= Current account + Savings account.

- Current accounts are business accounts and they do not give interest.

- Why Reserves are required?

- In the case of Bank runs the banks have to maintain a cushion for safety.

- Cash Reserve ratio, CRR

- It is the amount of money that banks have to maintain with RBI as a reserve in cash format. At present CRR is 4.5%

- Banks do not receive any interest on CRR

- When CRR increases- The money supply is going to decrease.

-

STATUTORY LIQUIDITY RATIO, SLR (07:04 PM)

- It is the amount of money that the banks have to maintain in a liquid format like Cash, Gold, G-secs, and T-Bills with themselves. At present SLR is 18%.

- SLR is maintained with the banks.

- If SLR will increase, the money supply will decrease.

-

- RBI is performing two functions

- a) Regulatory functions- Fixing SLR and CRR

- b) Debt management functions- RBI is issuing G-secs to raise the debt for the government.

- There was a debate regarding the conflict of interest, as RBI has to one side fix SLR and CRR and on the other side It is also the public debt manager. [* Hypothetically if SLR is increased by RBI then banks have to subscribe more to the G-sec. ]

OPEN MARKET OPERATIONS (07:26 PM)

- Open market operations deal with buying and selling of G-secs. RBI buys G-secs to inject liquidity and sells G-secs to reduce liquidity in the economy.

- USA, 2008, Global financial crisis/ Sub-prime crisis

- Prime customers- Who pay the loan on time

- Sub-prime- Who defaults?

- In the US, the government thought about the fiscal stimulus by decreasing the tax rates and increasing the subsidy. Also, an expansionary monetary policy was adopted.

- This increased the dollar supply and loans became cheaper. Indians also borrowed under external commercial borrowing (as loans were cheaper). Investors thought to diversify their business into India, china etc.

- After 2009, the Federal bank came up with Quantitative easing (Easy or expansionary monetary policy)

- Quantitative easing

- It is a bond-buying program performed by the Federal Bank of the USA to inject liquidity into the US market.

- Federal Tapering/ Tightening

- Rollback of Quantitative easing or stopping of Bond Buying activity.

- Federal tightening will lead to an increase in interest rates or reduce liquidity in the economy.

BONDS (07:48 PM)

- A bond is a piece of paper that mentions the price, interest or coupon, and maturity period. After the maturity period, the principal amount will also be given back.

- There is no compulsion to hold the bond till maturity. Every bond has some yield which is called yield.

- Bond Yield= Coupon/ Current price of the Bond

- If the price is 100, a coupon is 10 then Bond Yield= 10/ 100= 10%.

- When this paper is sold, it may be sold at a higher price or lower price based on circumstances.

- If the government issues another bond with a yield of 10.5%, and one decides to sell the earlier bond then it will be sold at 90rs as now the government has issued another bond that is offering a 10.5% yield.

- So now bond price= 90 and coupon is 10 rs so now Bond yield= 10/ 90= 11.1%

- If the bond is sold at 110 then the bond yield = 10/110.

-

Bond Price ∝ 1/ Bond yield.

- Impact of Inflation on bond yield

- When inflation increases, the bond prices decrease, and yield increases.

- When yield increases, then it is difficult to raise money. When raising a loan from the market one has to offer higher interest and the loan will become costly.

The topic for the next class:- Operation Twist and other quantitative tools.